Can Exceptional Service Be A Differentiating Value?

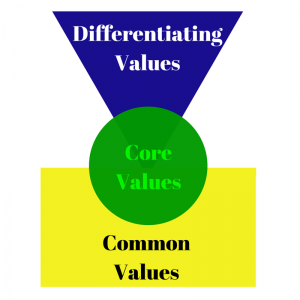

Executive Brief: Service is only a differentiating value if your competitors are lacking it. Even then, the benchmark for great service is set by other companies outside your industry that excel at providing exceptional service.

———————————————

Back in 2003, one of my clients was Sprint PCS. At the time, an independent report awarded Sprint with having the highest marks in customer service, when compared to other mobile phone providers.

Back in 2003, one of my clients was Sprint PCS. At the time, an independent report awarded Sprint with having the highest marks in customer service, when compared to other mobile phone providers.

Here was the problem.

With an overall low score (for example 3.2 out of 10), it meant Sprint’s customer service was still sadly lacking. Just because their competitors’ scores were all lower was no reason to celebrate.

Thankfully, Bill Esrey, the CEO of Sprint at the time, made a bold statement. He acknowledged that while Sprint may have had the highest score, they were simply “the queen of the pigs”.

In other words, Bill didn’t feel this score was worth celebrating. Instead, he challenged the organization to radically improve in the area of customer service. He saw the potential to differentiate in the area of service.

It appears that other business leaders have seen a similar opportunity.

The Unique World of Insurance

Unlike the exciting field of telecom, insurance is very boring. It’s also a very strange industry where you pay money for something you hope you’ll never need. As most agents will tell you, what you’re buying is peace of mind.

Unlike the exciting field of telecom, insurance is very boring. It’s also a very strange industry where you pay money for something you hope you’ll never need. As most agents will tell you, what you’re buying is peace of mind.

If you do unfortunately experience a car accident or a house fire, then you will encounter the company’s quality of service. Yet, your original purchase decision was made before you experienced their level of service.

So how do most people buy insurance? Based on price.

If the policy of Company A is cheaper than Company B, the choice appears to be obvious. This is what drives the marketing and advertising campaigns at many insurance companies, including:

- GEICO’s annoyingly popular “15 Minutes could save you 15% or more on car insurance”.

- Esurance (backed by Allstate) now promoting “7 ½ minutes could save you on car insurance.”

- Progressive’s spokeswoman FLO with her “Name your price tool”.

But price is not the only way to compete in this market. One company that states exceptional service as a differentiating value is Liberty Mutual Insurance.

Liberty Mutual Insurance

Liberty Mutual lists the following 3 values:

Liberty Mutual lists the following 3 values:

- We behave with integrity.

- We treat people with dignity and respect.

- We differentiate ourselves through exceptional service.

Based on my values research, Integrity, Dignity & Respect, and even Service are fundamental values that are shared by many Fortune-500 businesses. While they are critically important, they rarely create competitive advantage.

Yet, Liberty Mutual has chosen to plainly state that exceptional service is a differentiating value. Few companies state it this clearly.

Is this even possible?

First, consider what the value of Service means.

Service = an act of help or assistance; work that benefits another.

Many claim to embrace this value. Lots of companies are in business to provide help or assistance (for a fee). Or they build the cost of service into the price of their products.

In other words, providing reasonable customer service is table-stakes. It’s expected.

Companies Claiming Service as a Value

Just looking at the insurance industry, exceptional service is a stated core value at

- AIG (listed as a direct competitor of Liberty Mutual)

- State Farm Insurance

- Nationwide

- American Family Insurance

The challenge of differentiating on service is this: consumers don’t just compare your quality of service to your direct competitors; they compare their service experience across all companies.

A few of the many companies that state customer service as a core value include:

- Zappos – they have built an amazing business based on exceptional service, selling shoes and more online

- Home Depot – they started the company by hiring professionals to help buyers solve their DIY problems

- FedEx & UPS – they have built massive businesses by providing door-to-door service for any type of package

- Wal-Mart – yes, even the biggest discount retailer in the world claims to provide great customer service (Note: if you have experienced a Wal-Mart store that provided great customer experience, please add a comment below!)

For Liberty Mutual, hopefully they provide better service than Wal-Mart. But are they better than Zappos? That’s a pretty high benchmark to beat – especially when you only experience customer service if you have an accident.

So, how is Liberty Mutual fairing in making service a differentiating value?

A Shift In Messaging

A few years ago, Liberty Mutual ran an effective advertising campaign following the theme of Pay it Forward. The key message was to encourage everyone to “do a good deed” to a stranger. If everyone did this, the world would be a better place.

This brilliant campaign supported the company’s core value of exceptional service. The moment you needed some help, the folks at Liberty Mutual would be there.

However, a look at the company’s recent advertising shows a different flavor. They have shifted the focus away from service. The current ads promote “RISE” for a come back and “Responsibility”. While these ads have an emotional appeal, nothing in them supports the differentiating value of service.

Also of interest is that neither RISE nor “come back”, or Responsibility, are listed as core values.

To me, this suggests Liberty Mutual has struggled with making exceptional service a differentiating value. I do think they captured the essence of it a few years ago. But now they are fishing to find what makes them different from all the other insurance companies.

Maybe they’ll have to resort to simply competing on price…. can they provide a quote in under 3 minutes?

Do you believe any company can differentiate itself through exceptional service?

What would you recommend to Liberty Mutual as a differentiating value?

Today’s value was selected from the “Determination-Focus” category, based on the e-book Developing Your Differentiating Values.

I spent twelve years as a property/casualty insurance agent/manager. One of the things that drove me out of the business was after selling a prospect a policy (using a very colorful brochure printed by the company) the policyholder would come face to face with the claims department when they had an accident. j

So many times I ended up being the referee. Most of the time I ended up trying to console my client–actually trying to persuade them to stay with me.

I think insurance companies should start with the client meeting the claims people and hear how they interpret the policy. Then they could listen to the agents presentation. There is where they will find differentiation.

If they find the two departments in unity–they’re on to something big. Then they can truly compare companies customer service.

Thanks for sharing Tom. Your suggestion makes sense – great approach – though buyers would need a “guide” when meeting claims people. Could be a new role for agents… 🙂