No Surprise. The Wells Fargo Ethics Scandal was Predictable.

Wells Fargo has been fined $185 million by the city of Los Angeles, CA for generating fictitious accounts over a five-year period. And more charges may be on the way. Why? Apparently it was all in the name of achieving financial targets set by top executives.

As one of the largest banks in the world, with $1.9 trillion in assets, and with clearly stated values – one of them being Ethics – no one should be surprised that this scandal occurred.

It was unsurprisingly predictable.

Ethics Scandal Details

Apparently, thousands of bank employees opened more than 1.5 million unauthorized deposit accounts and more than 500,000 credit card accounts. This involved forging signatures, creating phony email addresses, shifting funds between real and phony accounts, and sometimes generating unwarranted fees for customers – to the tune of $2.5 million.

Apparently, thousands of bank employees opened more than 1.5 million unauthorized deposit accounts and more than 500,000 credit card accounts. This involved forging signatures, creating phony email addresses, shifting funds between real and phony accounts, and sometimes generating unwarranted fees for customers – to the tune of $2.5 million.

Why would employees do this?

According to The Fiscal Times, the bank invented a target for each customer called the “Gr-eight initiative”, with a specific target to achieve eight add-on products per customer household. This initiative was introduced by former CEO Dick Kovacevich and included some severe employee incentives.

“Employees who missed sales quotas would have to work weekends or stay late to catch up. They were also threatened with firing. To handle the pressure, some employees opened accounts or ordered credit cards without customer permission. Wells Fargo says 5,300 workers have been fired for such conduct over the past five years.”

Looking in my own files, I found proof of this “gr-eight” initiative in a previous Vision & Values document, as outlined further below.

Note: Wells Fargo provides a direct response to this scandal on their website, specifically highlighting the importance of the bank’s mission as outlined in its Vision & Values booklet.

Wells Fargo Values

For background purposes, Wells Fargo has five stated values as outlined in its Vision & Values document:

- People as a competitive advantage

- Ethics

- What’s right for customers

- Diversity and inclusion

- Leadership

Interestingly, the bank makes the following statement about its value of Ethics:

“Our ethics are the sum of all the decisions each of us makes every day. If you want to find out how strong a company’s ethics are, don’t listen to what its people say. Watch what they do.”

So how does such a violation of ethics occur, especially with over 260,000 employees supposedly keeping each other accountable?

In the letter from CEO John G. Stumpf that’s posted on the bank’s website, the claim is made that the bank has stayed true to its vision for more than two decades, as outlined in its Vision & Values document. But it doesn’t say anything about remaining true to the bank’s values.

An Intricate and Complex Document

I wonder how many changes and tweaks have occurred to the bank’s Vision & Values document since it was first published in the early 1990s?

One thing I do know is that a lot has changed since December 2013 when I first reviewed the bank’s Vision & Values. When comparing the 2013 Vision & Values document with the current one, here are the major items I see have changed in less than three years:

- The entire document was reformatted, from a 44-page single page to a 21-page double column, with many edits throughout the document, plus the moving around of major sections.

- Under the section “One Wells Fargo” the last portion was dropped, which outlined how employees should communicate with customers using a C-A-R-E model (Consistent, Approachable, Respectful, Empathetic), plus some nice examples showing how to follow this model.

- Under the section “Disciplined, responsible lending” the bank changed from 5 principles to 4. The first two are the same, but dropped the third and modified the last two principles. Of interest, the clarity of #4 is gone, which used to state “Making sure every loan we make provides a demonstrable benefit to the customer.” This change seems quite relatable to the scandal, so not sure why it was removed as it’s more important now than ever.

- Under the section “Risk management” the bank increased their core principles from 6 to 7 and modified the wording of almost all of them. A few of the more interesting changes include:

- Under #1 “Relationship Focus”, dropped the reference that the bank does not offer products that “…fail to serve our customers’ best interests…”

- Changed the label of principle #2 from “Competitive advantage” to “Understanding risk”.

- Under #3 “Reputation”, dropped the specific reference that the bank will not engage in activities or business practices that could cause “…permanent or irreparable…” damage to its reputation.

- Added in a new principle (now #6) “Operational excellence. Our customers expect that we will be a reliable provider of services. Our team members are committed to excellence and are focused on optimizing efficiency and effectiveness while minimizing errors.”

- Changed the label of the last principle from “Dual control” to “Clear accountability”

- Replaced two entire sections, one addressing the different types of risk, the other titled “Managing our resources”, with a new major section titled “Corporate social responsibility”.

- Under the section “Culture first, size second” the bank removed an important section addressing its focus on returns and stock performance.

- The bank made major edits to the section “Our brand”, altering the brand promise and changing and expanding the number of principles from two to three. They also removed a listing about their commitment to customer, including, “Do the right thing for the customer.”

- Significant editing and additions were made to the section titled “Our six priorities” (formerly five priorities. A sixth priority has been added called “Managing risk”.

- Altered the entire section under “Our strategy”. It was here that the bank previously outlined the core of its “vision-based strategy of “cross-selling” – the process of offering customers the products and services they need, when they need them, to help them succeed financially.” In the revised document there is now only a single reference to cross-selling, with the strategic focus now on “deepening customer relationships.” Of interest, there is a special emphasis, “We start with what the customer needs – not with what we want to sell them.” This appears to be added in response to the scandal.

Clearly there are a lot of changes that have been made to the bank’s Vision & Values document. But the biggest one is the removal of an entire section about where it sees its opportunities.

Going for gr-eight

When comparing Vision & Values documents (2013 and 2016 documents), the most significant change is the removal of the entire section called “Our opportunities”. This section included a listing of 6 key areas the bank was focused on to improve and grow its business.

The current scandal appears to be focused on what was called Opportunity #2 – “Going for gr-eight”, which stated:

“Our average retail banking household has about six products with us. We want to get to eight . . . and beyond. One of every four already has eight or more. Four of every 10 have six or more. The average banking household, for example, has about 16 products. Our average wholesale bank relationship has six products with us and our average commercial bank relationship, eight. Our wealth management, brokerage and retirement customers lead the pack with an average of 10 products per customer.”

Should anyone really be surprised that this scandal occurred? And what about the other five opportunities on which bank executives were focused? Should anyone be surprised to find a lapse in ethical behavior in these areas too?

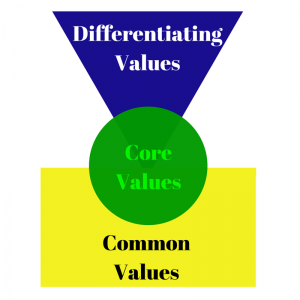

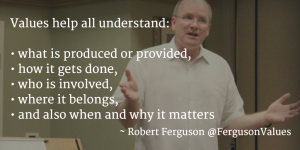

When business objectives are stated within a values document, it confuses priorities for all employees. It is not surprising to experience behaviors that are aligned with achieving business objectives even when they overrule expected behaviors that support stated values.

Bottom line: the definition of values and business objectives do not belong together. Objectives change. Values should not. If values are to have a real and lasting impact, then communicating the rewards for living the values and punishments for violating them need to always be viewed as the organization’s top priority. Values need to be in its own document, and rarely changed.

—————————–

Are you surprised by the Wells Fargo scandal?

What would you recommend the bank do differently to prevent future problems?